08

April 18, 2023

Off-payroll working – what you need to know.

HMRC has the green light to pursue companies that aren’t taking the threat seriously

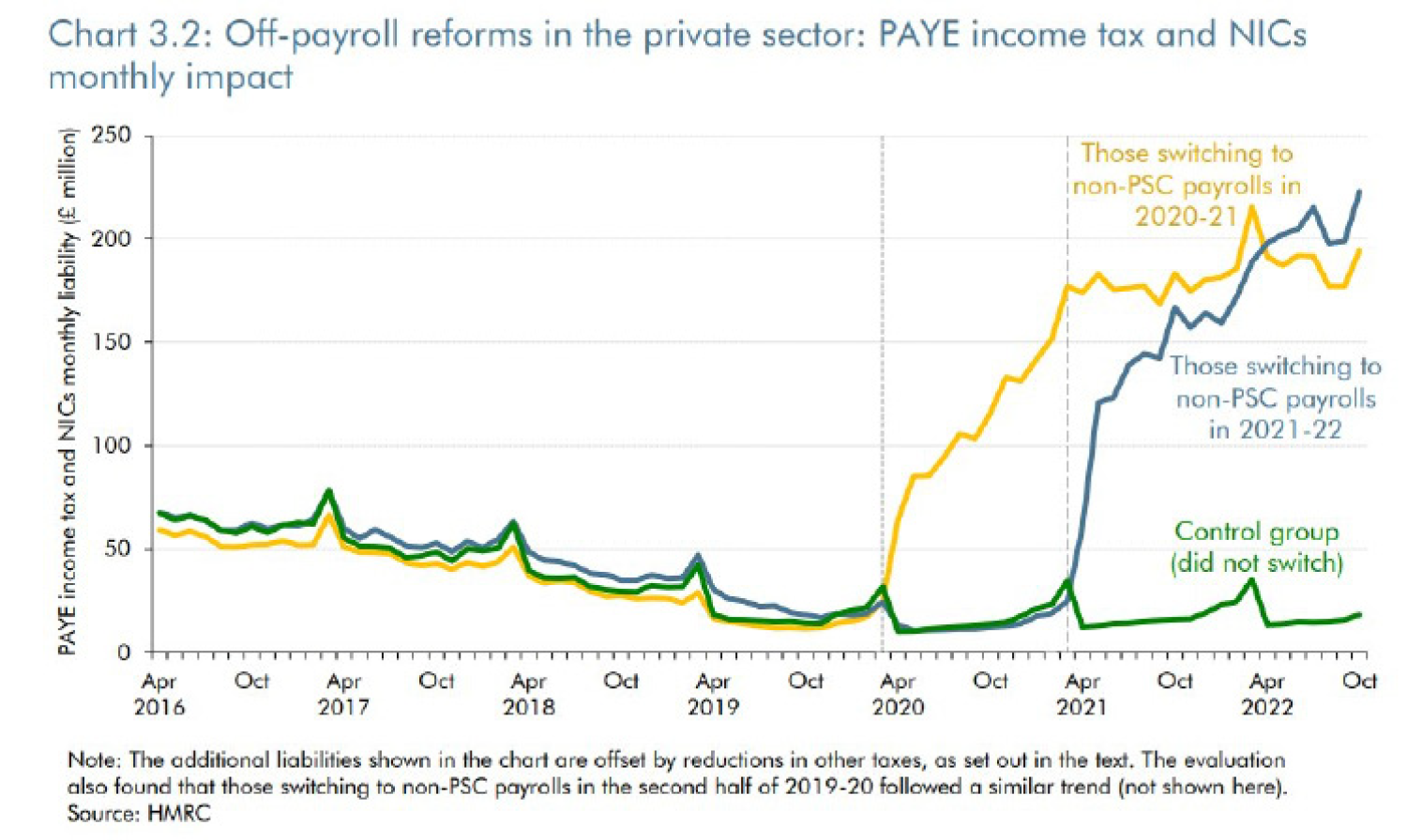

When off-payroll working rules were first introduced to the public sector in April 2017, the impact was immediate. In a knee-jerk reaction, organisations reclassified freelancers and put them on the payroll for deduction of PAYE and National Insurance Contributions.

It was just the response HMRC hoped for. For very little effort, it achieved an immediate and significant increase in revenue.

Source: Office for Budget Responsibility, [date March 2023]

Revenue spiked at the beginning of each tax year as organisations scrambled to comply, and jumped considerably from April 2020 when HMRC ramped up the pressure on businesses.

But those figures don’t reveal the true costs to these organisations, which also had to deal with pension contributions, holiday pay and other costs associated with employment. The other hidden cost was to those freelance workers (personal service companies) whose contracts were simply terminated following the introduction of the rules.

What unfolded in the public sector when Off Payroll working was first rolled out in April 2017, was a continuation of what HMRC had relied on since the introduction of IR35 in 2001. Through a combination of businesses’ knee-jerk reactions and ill-informed responses, the Exchequer has enjoyed a significant boost in income.

Expensive mistakes

Failure to get to grips with the issue is still proving costly. HMRC has recently had major success recovering £35m from one public authority that didn’t understand and didn’t prepare. We understand an even bigger financial recovery is in the pipeline from another organisation.

The private sector needs to sit up and take notice.

So, what did these organisations do wrong that gave HMRC the opportunity to prove they’d fallen foul of the regulations?

- They didn’t have a detailed understanding of IR35 and off-payroll working rules.

- They buried their head in the sand.

- They didn’t have adequate systems and procedures in place.

- The quality of their documentation was inadequate to deter HMRC.

- They didn’t believe HMRC was serious about pursuing businesses in respect of their IR35 and off-payroll working compliance.

No escape

There was a brief period last year when businesses and contractors thought they were off the hook. In his disastrous mini-budget in September, ex-chancellor Kwasi Kwarteng announced plans to repeal the IR35 off-payroll working rules. But that was rapidly scrapped by his successor, Jeremy Hunt. That means the complex rules are here to stay.

That’s great news for HMRC, which is now looking forward to more rich pickings from the private and public sector alike. And the tax authorities have got good reason to be confident.

Plenty of businesses still don’t fully understand the rules and are making knee-jerk decisions in response to press and social media coverage. And there are organisations still choosing to bury their heads in the sand or devolving the decision-making process to third-party agencies.

The bad news for private sector companies is that they are now firmly in HMRC’s sights following the introduction of off-payroll working from April 2021. What’s more, the inspectors who previously had little experience of the complexities of employment status and IR35 now know a lot more about what to look for after their investigations in the public sector.

Good habits

Doing nothing could be a very costly option. So too could making the knee-jerk decisions HMRC rely on. But expert help is available to save you time and money, and put your business in the best place when the inspectors call.

Whether in the private or public sector, we believe businesses need to address some key areas to deal effectively with the IR35 and off-payroll working rules:

- Understanding of what the IR35 (employment status) test involves

- Communication between the business, freelance worker (personal service company) and other parties

- Understanding the impact each IR35 decision has on off-payroll working

- Provision of education, guidance and training for all relevant staff

- Introduction of appropriate processes, systems and audit trail of decisions, including ongoing reviews to demonstrate compliance

- Utilising the services of specialists to provide the advice and solutions to help mitigate risk.

We’ll cover these topics in more detail in future articles, but what underpins compliance is ensuring the right due diligence and preparation is done – before HMRC arrive at the door.

Our experience and conversations lead us to believe a significant number of medium-sized and large organisations in the UK have taken insufficient steps to comply with the off-payroll working rules and are extremely vulnerable to attack by HMRC.

Help at hand

Inspired Employer Solutions Ltd (IESL) has developed IR35 App (www.ir35app.co.uk), a first-to-market solution to help businesses navigate the complexities of IR35 and off-payroll working regulation. The web-based app delivers bespoke and comprehensive support to put in place the best possible defence for your business and make HMRC think twice before challenging your contractual arrangements.

IR35 App is designed and supported by IESL’s specialist team. Geoff Heron and Adrian Williams, IESL’s directors, are former HMRC investigators and senior managers with a Big Four accountancy firm. They are joined by Steve Gretton, a former employment status inspector who formerly spearheaded IR35 investigations at HMRC. We are confident that no Big Four firm or other accountancy practice can provide the same expertise and knowledge as the team at IESL.

IR35 App is not available as an off-the-shelf package, as we believe it’s imperative that decision-makers get the opportunity to see and understand the benefits and value it offers before pressing ahead.

In a face-to-face meeting, Adrian and Geoff will demonstrate the app, explain the support and extras that come with it, and answer any questions.

To find out more, contact Adrian or Geoff via the link at www.ir35app.co.uk.